p-prospekt.ru Peters Pond Site Map

Get more information for Peters Pond RV Resort in Sandwich, MA. See reviews, map, get the address, and find directions. May 13, - This pet-friendly campground has token-operated showers, boat launch, fish-cleaning stand and an onsite caretaker. Some sites accommodate more than one unit or one large unit. The Peter's Pond area of the campground offers power & water sites, and the Boat Launch Loop area offers. January 16, - The well-loved Paddle-River Dam Campgrounds are home to an abundance of outdoor opportunities including fishing, boating, hiking and wildlife viewing. Pack your gear, bring your camera and get ready for an outdoor adventure in the heart of Alberta · Learn about Accessible Camping in Alberta Parks. August 29, - There he explored waterways around Lake Athabasca and determined the approximate locations of Great Slave Lake and Great Bear Lake from First Nations peoples of the area. From his notes and diaries Peter Pond drew a map showing rivers and lakes of the Athabasca region, including what was known. We cannot provide a description for this page right now. Peter Pond Mall - Visit Fort McMurray's premier mall with over 65 retailers and services. Come shop at these brand name stores: Le Chateau, Aldo, Garage, Telus and much more. Sun Retreats Peters Pond, Sandwich. 6, likes · talking about this · 21, were here. Welcome to Sun Retreats Peters Pond located in Sandwich, MA. March 9, - The proponent plans to remove rock and gravel from an existing quarry site located approximately metres from Peter’s River, in the Botwood area along Route in central Newfoundland for the purpose of producing crushed gravel. Explorer and fur trader, one of the founders of the North West Company. November 26, - Originally called Big and Little Buffalo Lakes, it was renamed after Peter Pond in It is on Highway which passes through Buffalo Narrows. 55°53′00″N °36′03″W / °N °W) (formally Big Buffalo Beach Recreation Site), is a recreation site about Peter Pond (/) was the pioneer who opened up the Athabasca region to European awareness, exploration and, ultimately, economic development. December 16, - Signing up enhances your TCE experience with the ability to save items to your personal reading list, and access the interactive map. Create Account Graham, Jane E.. "Peter Pond". The Canadian Encyclopedia, 16 December , Historica Canada. p-prospekt.ru Nice shady good size sites - clean restrooms & showers - friendly helpful staff - small lake adjacent - close to Plymouth & all of Cape Cod - will stay again - visited with a motorhome & toad Peters Pond in Sandwich, Massachusetts is a Cape Cod RV resort and campground that is great for. Reproductions of maps created by Peter Pond () fur trader and explorer. The accompanying book has not been scanned. [Showing Pacific Ocean, Artic Circle, Hudson Bay, Great Lakes.] Map One Copy of map presented to the Congress by Peter Pond, March March 24, - Paul, ) Directory of Canadian map by Peter Pond Join Nikki's mailing list to receive the latest news and updates. It's free, and you can opt out anytime! I see we have similar interests. Enjoyed your blogs on Peter Pond. Please write back. Reply I see we’re both interested in Peter Pond. My website is p-prospekt.ru Looking forward to corresponding with you. Reply Thanks for your interest in my site. Peter Pond Lake fishing map, with HD depth contours, AIS, Fishing spots, marine navigation, free interactive map & Chart plotter features. November 17, - Copy of a map presented to Congress of the United States and to the Lt. Governor of Quebec by Peter Pond, August 11, - Peter Pond is just west of Emsworth at Hermitage and was originally a working mill pond, supplying water to drive the old flour mill. Peter Pond is a ‘saline lagoon’ that is just under 3 acres in size. It is tidal, being connected to Chichester Harbour, and it naturally mixes fresh water. POND, PETER, army officer, fur trader, explorer, map maker, and writer; b. 18 Jan. /40 in Milford, Conn., eldest son of Peter Pond and Mary Hubbard; m. Susanna Newell, probably in , and they had at least two children; d. in Milford.

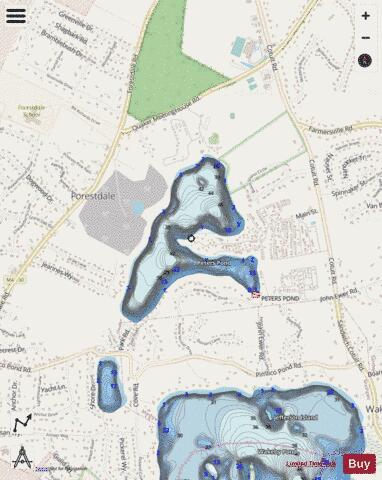

To support our service, we display Private Sponsored Links that are relevant to your search queries. These tracker-free affiliate links are not based on your personal information or browsing history, and they help us cover our costs without compromising your privacy. If you want to enjoy Ghostery without seeing sponsored results, you can easily disable them in the search settings, or consider becoming a Contributor. Find your Sunnier Side at resorts with RV & tent camping sites, vacation rentals and homes with fantastic amenities in amazing places across the US and Ontario. . The Department of Correction oversees the state prison system, managing 13 institutions across the state. We provide custody, care, and programming for those under our supervision to prepare them for safe and successful reentry into the community. . Check availability Click on Rates Pond Check Availability Click on Book Your Stay for Sun Retreats Peters Pond Please call us at () for more information about lodging, seasonal RV sites or vacation home sales. . Peters Pond fishing map, with HD depth contours, AIS, Fishing spots, marine navigation, free interactive map & Chart plotter features . Peters Pond · Acres = 74 +/- Perimeter = feet · Length = feet (2/3 of mile) Width = feet (1/4 of mile) Average Depth = 10 to 15 feet · Cedar Pond · Acres = +/- Perimeter = feet · Average Depth = unknown · THE LAKE - Satellite Map · . We cannot provide a description for this page right now . The 12 acre pond is 60 feet deep, and features steep granitic cliffs. No houses are visible anywhere around the pond, giving a sense of deep isolation and beauty. Peters Pond Preserve Dutch Neck Waldoboro, ME . Plan your next trip, read reviews and get travel advice from our community on where to stay and what to do. Find savings on hotels, book the perfect tour or attraction, and reserve a table at the best restaurants. . One of the finest resorts in Cape Cod, Sun Retreats Peters Pond is situated along the shores of a beautiful spring-fed pond. Here, visitors can relax in the serene environment or participate in the many onsite activities, including softball, horseshoes, volleyball and bocce ball. . If you enjoy Ghostery ad-free, consider joining our Contributor program and help us advocate for privacy as a basic human right.

Quality made in America durable coated canvas ID wallet key chain with leather patch to personalize with initials or monogram. . Our fan favorite is back with new designs! This durable wallet allows you to carry everything you need while staying small and compact. . Google Wallet is a safe way to store and use your cards, tickets, passes, keys, and IDs. Get started with Google Wallet. . Discover the Marni women's accessories collection on the official store. Shop online made in Italy wallets and small leather goods. . Order your handcrafted leather wallet today. Made in Maine from American cow hide, ORIGIN™ genuine leather wallets feature heavy-duty corded stitching for . Explore our vibrant collection of women's wallets in various colors and materials. Discover the perfect accessory for every occasion! . This sleek vegan-leather wallet effortlessly and securely attaches to your iPhone in a snap connection so you can conveniently carry your cards, ID, or even . Wallets & Card Holders · Wesport Tri Fold Wallet, CHOCOLATE Add to cart + Quick Shop · Wardville Pouch Wallet, CHOCOLATE Add to cart + Quick Shop · Wesport Tri . Get help finding a bitcoin wallet. Answer a few basic questions to create a list of wallets that might match your needs. .

Prince Albert, Saskatchewan Peter Pond, a shrewd independen the Athabasca trade using detailed maps he drew from Aborigi Fur Trader Built the first trading post on this site, . Peters Pond Anyone interested in fishing Peters Pond or waters within the wider area aroundDracut should consult with local resources before heading out to fish. Anglers who are fa . Oct 7, - The site is today a National Historic Site. Pond Infobox person Peter Pond {{Birth-dateJanuary 18, Peter Pond p-prospekt.ru . Site - - Buffalo River Dene Nation - - PETER POND LAKE INDIAN RESERVE NO. - SK04 . Site - - Buffalo River Dene Nation - - PETER POND LAKE INDIAN RESERVE NO. - . St. Peters Canal National Historic Site Site plan (PDF - KB, greyscale) Site and context map (PDF - KB, greyscale) . Mar 17, - on February 13, , Pond was named after his ancestor, the explorer Peter Pond. June 23, , as he was leaving the Khmer Rouge refugee camp Site 8Site 8 where he had be . Peter Pond Topo Map in Decatur County GA Buy This Printed Topo Map Coordinates: °N, °WApprox. Elevation: 79 feet (24 meters)USGS Map Area: FacevilleFeature Typ . Peter Pond Learn about this topic in these articles: In one of them, Peter Pond, found Portage La Loche (Methy Portage) connecting the headwaters of Churchill River with the C .

[14 miles ( km) This route uses sections of the the and the to create a circular walk around this Suffolk based village. It's a very pretty settlement with many cottages and old timber-framed houses. There's also a noteworthy village church which dates . The written history of Boston begins with a letter drafted by the first European inhabitant of the Shawmut Peninsula, William Blaxton. This letter is dated September 7, , and was addressed to the leader of the Puritan settlement of Charlestown, Isaac . Great Haseley the History of the AreaThere is little Published on the History of Great Haseley. Chief amongst the unpublished sources is Delafield’s History-Manuscript Volumes in the Bodleian Library, which give a History of the Village up to the early . Welcome to Cardross Welcome to this Discovering Britain walk in Scotland created by a team from the School of Geographical and Earth Sciences at the University of Glasgow. We’re in the village of Cardross about 20 miles northwest of Glasgow city centre on . Following the successful Tai Chi session at last month the have arranged two more Tai Chi sessions, the first tomorrow (Sunday 23rd August) at pm. Madeleine from the Friends wrote with details: Following a wonderful Tai Chi session held as part of the . Rennes les Bains attracted many legends: a Greek ‘Arcadia a Celtic ‘stone circle a Roman ‘Legion Judaeo-Christian and Visigoth ‘royal exiles Cathar heretics, Templar ‘geometers and correspondence theorists. It welcomed dinosaurs, Ice Age hunters, outposts . The inclusion of a site in the Tile Gazetteer does not guarantee any availability of public access nor that any listed site remains in existence or is unchanged. and Use your browser Back button to return to an existing TACS Database Search, or Devon is a . The Hidden Truth Behind The News Barak Listen up, I can’t take sides on this issue as we have huge investments in Latin America” Barak May I suggest you get a couple of our oil big boys such as Anadarko involved and maybe you can drag us into a potential . Arrival 1 Night Departure Guests Children infants Pets Reservation Center: Reservations Please call us at for more information about lodging, seasonal RV sites or vacation home sales. Book your stay within 30 days of arrival at Sun Retreats Peters Pond. C . The Canals Trust have over 2, miles of waterway to look after for the many interest groups who use them. With so much water it is no wonder that fishing is high on the list of activities. The Trust issues a Waterway Wanderers Permit that entitles you t . Get on your bike and ride, it's Curbed Boston's first-ever Outdoors Week! Herewith, then, an expanded and updated map of the best places to bike in our fair region that don't require a car to get to them. Instead these are eminently bike-able or accessibl . The billion tons of coal burned each year in the United States contain tons of mercury, tons of arsenic, tons of beryllium, tons of cadmium, tons of chromium, tons of nickel, and tons of selenium. On top of emitting 1 . Five Points intersection painted by George Catlin in Anthony Street veers off to the left, Orange Street on the right and Cross Street runs left to right in the foreground. The dilapidated tenement buildings to the left of Anthony St were torn down . Sunday 9 June, multiple locations across the West of England Festival of Nature is coming to your neighbourhood! Community Day is a day to celebrate the actions your community are taking for nature across the West of England region. Discover a new, local . This is possibly the oldest photograph, actually a Daguerreotype, of New York City. I have enhanced this image to provide greater detail. The original sold for $62, at an auction at Sotheby's in March of The photo was found at a small auction in . He waited downstairs while we got a bit freshened up and went down to meet him again. He took us to a restaurant in what we thought was a former railway station (we found out later that, despite the name, it was a former nunnery You walk into a long hall . Posted: 11th September by The Hatching Cat in Tags: Cozey Bell was the beloved Skye terrier of Mrs. Mary A. Bell (this is not actually Cozey His much publicized burial at Woodlawn Cemetery resulted in tremendous public outcry. On September 26, , . Impact Area Review Team Christ the King Parish February 22, p.m p.m. Meeting Minutes Members: Organization: Attendees: Organization: Hap Gonser IAGWSP Kris Curley IAGWSP Ben Gregson IAGWSP Lori Boghdan IAGWSP Marty Aker AFCEE/MMR Pamela Ric . Although mental health conditions can be successfully treated at a low cost, studies have found a significant gap between individuals needing care and those able to access it. According to the WHO, to close this gap, three things need to happen: better un . The active map is now Sadly, we lost Leif in the D.R see below Don't forget to refresh your browser to be sure to catch the latest updates (below the map black Adult female tagged with her mate, Hacket, at her nest in Annapolis, MD. on 3 May Adult ma . While aimlessly wandering in Hollis the other year, I noticed, when walking north on th Street, that it had to make a rather drastic S-curve between 90th and 91st Avenues. The photo is looking north from about 91st Avenue. There’s a cause for every eff . 'The Friends'were officially constituted on the 7th June Lord Petre, whose great, great, great, grandfather had been amongst the first major shareholders, agreed to become our president and confirmed his enthusiasm at the launch by singing 'Messing . The hike through Lower Doane Valley and French Valley at Palomar Mountain State Park is a gem; every twist and turn offers something natural and beautiful. You'll follow the lush Doane Creek, hike through groves of giant trees, across mountain meadows, vi . December 31, pm Filed under December 21, pm over at picked up on a video by where they use as vehicle for a clever Year in Review that breaks down the major news events. As Dybwad writes, this video shows the potential for Wave . I am worried about the extra traffic in this area as locksheath free church has been given the go head to expand PO14 I do not believe this space is suitable for 38 'dwellings The plot is tiny, 10 'dwellings' would be more suitable (parking space etc I'm .